Introduction: A Star Target Rising, But How to Shine Globally

In the quest to treat refractory autoimmune diseases, Kv1.3 has emerged as a rising star target. Kv1.3 is a voltage-gated potassium channel pivotal in T-cell activation – blocking it can dampen the inflammatory response driving autoimmune pathology. In conditions like ulcerative colitis, patients show abnormally high Kv1.3 expression on their immune cells correlating with disease activity, underscoring the channel's therapeutic appeal. The medical need is enormous: over 8 million people suffer from inflammatory bowel disease (IBD) worldwide, and the autoimmune therapeutics market is projected to surge to $140 billion by 2028 (with IBD alone accounting for $28B). In short, Kv1.3's potential in immunology is turning heads as a promising way to "reset" the immune system in multiple diseases.

Yet for the many biotech innovators (especially those in emerging hubs like China) holding promising Kv1.3 drug candidates, a sobering challenge looms: "Even the best wine needs to find its way out of a deep alley." In other words, an excellent early-stage program means little if it remains unseen by global partners. How can these companies successfully bring their Kv1.3 assets to the international stage? How do you find and secure the right overseas partner who recognizes the value of your science and can carry it to global markets?

This article offers a data-driven "global collaboration battle map" for the Kv1.3 landscape. We will chart the worldwide R&D pipeline, reveal who the key players at the table are, and decipher how different regions deal their cards when it comes to licensing preferences. Most importantly, we'll provide a clear how-to guide for identifying your ideal partner and negotiating effectively – with insights into how Unibest can be your guiding ally in unearthing the hidden treasures on this map.

(Now, let's dive into the map!)

Global Kv1.3 R&D Landscape: Mapping the Players and Pipeline (The Landscape)

Global Pipeline Overview – Who's in the Game: According to Unibest's internal Data Intelligence Platform, there are currently around 9 active drug projects targeting Kv1.3 worldwide in various stages of development. These range from early preclinical molecules to one program that has reached Phase III trials. Geographically, Kv1.3 R&D is truly global. As shown in Figure 1, roughly half of active programs are based in Europe (e.g. UK, Netherlands, Denmark), about one-third in North America (primarily the US), and the remainder in Asia (notably China). This broad distribution reflects international interest in the target – from Big Pharma in the West to emerging biotechs in Asia – all vying for a therapeutic edge.

Figure 1: Regional distribution of active Kv1.3-targeted drug programs (source: Unibest Data Intelligence Platform). European and UK companies account for ~44% of current Kv1.3 projects, North America ~33%, and Asia-Pacific (mainly China) ~22%. This highlights a diverse global participation in Kv1.3 R&D.

In terms of development stage, the majority of Kv1.3 assets are in preclinical or Phase 1 trials, with a smaller number advancing to proof-of-concept in patients. Figure 2 illustrates the pipeline by stage. Out of the active programs identified, 3 are in preclinical research, 3 in Phase 1, 2 in Phase 2, and 1 in Phase 3 (a China-based program targeting cardiac arrhythmia). Notably, Phase II is the pivotal "make-or-break" stage where human efficacy gets demonstrated – and often, where licensing deals heat up. Industry-wide, assets that reach Phase II command dramatically higher valuations; for instance, average upfront payments for Phase II-stage licensing deals have spiked ~460% in recent years compared to early-stage deals. In other words, showing clinical proof-of-concept for Kv1.3 (e.g. improving psoriasis or ulcerative colitis in patients) can be a game-changer that ignites bidding wars. It's no surprise that the two Kv1.3 programs currently in Phase II are watched closely as prime partnership opportunities.

Figure 2: Global Kv1.3 pipeline by development stage (active projects only, source: Unibest Data Intelligence Platform). The majority of programs are in Preclinical or Phase I, with only a few reaching Phase II (often the hotspot for licensing deals) and a single Phase III program. This early-stage skew underlines both the cutting-edge nature of Kv1.3 research and the opportunity for partnerships to propel these programs through clinical validation.

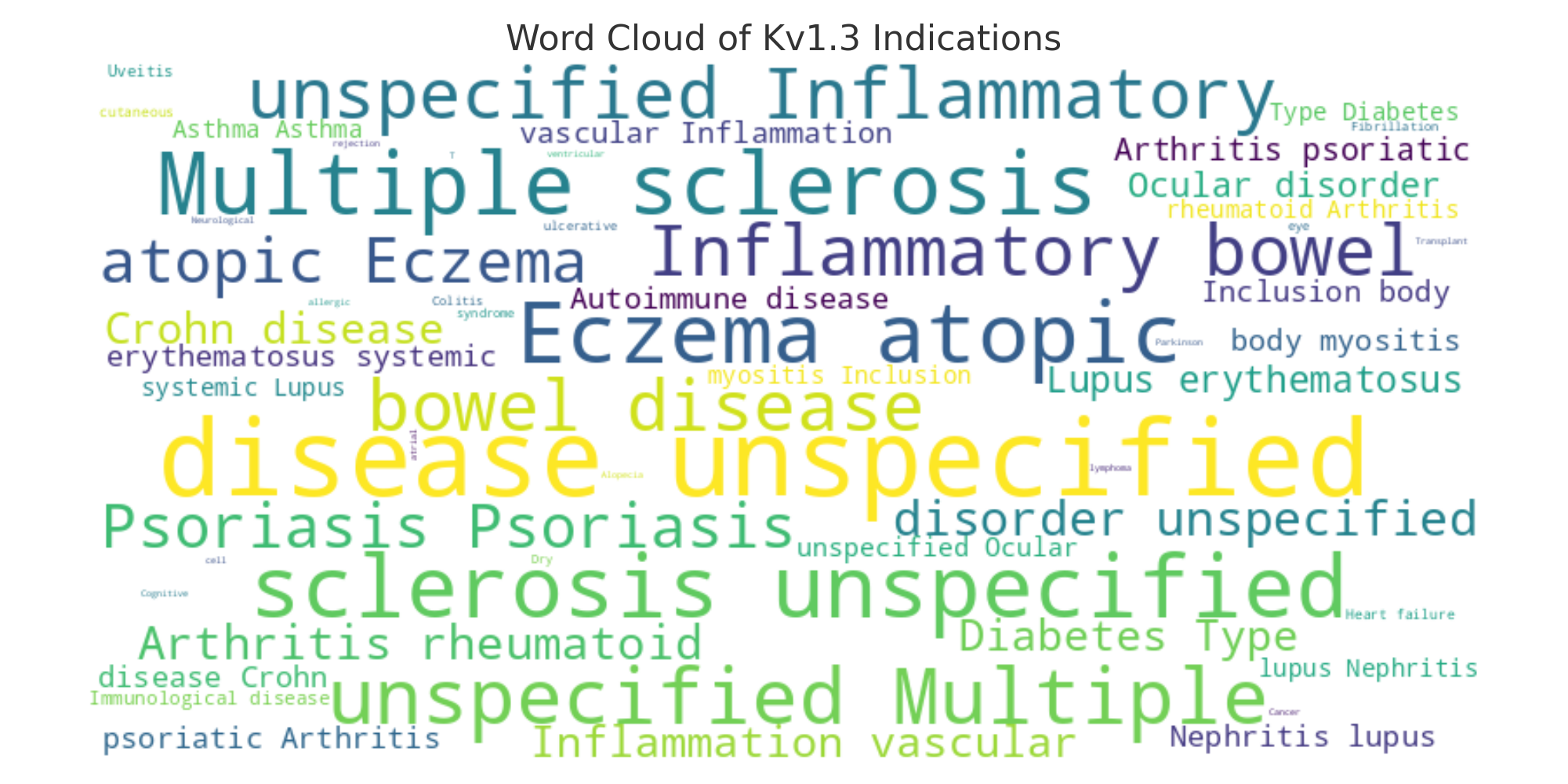

Therapeutic Focus – Where Are These Programs Aiming? Almost all Kv1.3-targeted therapies under development are aimed at autoimmune and inflammatory diseases, but within that broad category there are distinct frontiers. The hottest battlefield is in immuno-dermatology and immunology: atopic dermatitis (eczema) and psoriasis are the most common indications pursued, alongside psoriatic arthritis and related chronic inflammatory skin conditions. The next major focus area is Inflammatory Bowel Disease (including ulcerative colitis and Crohn's disease). A few programs extend into other autoimmune niches – for example, one biotech is exploring Kv1.3 blockers for multiple sclerosis, and another has a unique program targeting autoimmune-related arrhythmias in the heart. The word cloud in Figure 3 illustrates the prominence of each indication across current Kv1.3 pipelines (with larger text indicating more programs targeting that condition). We can clearly see atopic dermatitis and psoriasis looming large, reflecting how Kv1.3's immune-sparing mechanism is especially attractive for T-cell–driven skin disorders. Likewise, IBD (ulcerative colitis/Crohn's) features heavily – a logical target given the correlation between Kv1.3 and gut T-cell inflammation. Meanwhile, neurological applications (e.g. MS) and others are present but comparatively small slices of the pie. This suggests that most companies view dermatology and GI diseases as the "sweet spot" for Kv1.3 therapies, where unmet need is high and a targeted immunomodulator could offer safer, more durable relief than broad immunosuppressants.

Figure 3: Word cloud of indications being pursued by current Kv1.3 pipeline programs (source: Unibest Data Intelligence Platform). Autoimmune skin diseases like atopic dermatitis and psoriasis appear most frequently, followed by inflammatory bowel diseases (ulcerative colitis, Crohn's). Other targets like multiple sclerosis (neurologic autoimmunity) and even T-cell driven cardiac arrhythmias show Kv1.3's diverse potential, though these are more niche. The prominence of dermatologic and GI indications aligns with Kv1.3's role in pathogenic T-memory cells, which drive many of these conditions.

Key Players – Who's at the Table? Even with a relatively small number of active programs, the Kv1.3 field features an interesting mix of players: from biotech startups to at least one top-tier pharma. A quick scan of the pipeline highlights a few names:

Eli Lilly – This global pharma giant has bet on Kv1.3, not once but twice. Lilly is advancing an internal small-molecule Kv1.3 inhibitor (LY-3972406) now in Phase II for psoriasis. They also struck a high-profile deal with drug discovery firm D.E. Shaw Research to license DES-7114, a preclinical Kv1.3 blocker, paying $60 million upfront (with up to $475 million in milestones). Lilly's aggressive move – investing early in a Kv1.3 program – validates the target's promise and suggests Lilly aims to be a front-runner in this space.

SelectION, Inc. – A biotech headquartered in San Diego (with R&D in Munich), selectION is developing si-544, a Kv1.3-blocking peptide, and has already reported positive Phase 1b results in atopic dermatitis. They're now expanding into psoriasis trials. SelectION's approach is to selectively hit chronically activated T-cells via Kv1.3, and their initial human data showing safety (and hints of efficacy) bolsters the case that Kv1.3 inhibitors could offer a new standard of safety in autoimmune therapy. This startup is a "one to watch," potentially seeking partnerships as it moves toward Phase 2.

European Biotech "Dark Horses" – Several innovative European startups are in the Kv1.3 race. VRG Therapeutics, based in the Netherlands (with Hungarian roots), is developing a miniprotein Kv1.3 inhibitor for atopic dermatitis and psoriasis. They recently engineered an extended half-life version enabling monthly dosing – a major differentiator for patient convenience – and have raised significant funding to push toward clinical proof-of-concept. Muna Therapeutics, a Danish/Belgian biotech, is exploring Kv1.3 blockers for an unconventional application: Parkinson's disease. Backed by a $4.9M Michael J. Fox Foundation grant, Muna is testing whether inhibiting Kv1.3 can quell microglial-driven neuroinflammation to slow neurodegeneration – a novel angle that, if successful, could open Kv1.3 to neurodegenerative markets. Zealand Pharma (Denmark) also has a Kv1.3 oral drug (ZP-9830) in Phase 1, aiming at IBD. These companies may be smaller, but their specialized focus and recent financing wins (e.g. VRG's €5M Series A) mark them as rising players likely looking for larger partners as their programs advance.

China's Emerging Players – Notably, China is home to a couple of the most advanced Kv1.3 programs. Yirui Pharma (YR-001) is a Chinese biotech developing a Kv1.3 inhibitor for autoimmune dermatology (atopic dermatitis, psoriasis) and alopecia. Meanwhile, Yangzhou Zhongbao has a Kv1.3 modulator in Phase III trials – uniquely targeting atrial fibrillation (a heart rhythm disorder). This outlier indicates Kv1.3's mechanism might extend beyond classical autoimmunity. Chinese biotechs are actively pursuing Kv1.3 and, given China's huge market and growing R&D capabilities, they could be attractive regional partners or acquisition targets for global companies seeking to expand pipelines.

Former Contenders & Others – A few earlier efforts at Kv1.3 have fallen by the wayside, highlighting challenges in drugging this target. For example, Sanofi/Ablynx's once-promising Kv1.3 nanobody showed preclinical efficacy but was discontinued. Companies like City of Hope (aminopyridine analogs) and Tetragenetics/AbCellera (antibodies) also had programs that ceased. These "lost battles" underscore that while the Kv1.3 concept is powerful, executing it (achieving selectivity, bioavailability, etc.) is tricky. The current cadre of active players have learned from these past attempts, leveraging advanced modalities (peptides, miniproteins, ultra-selective small molecules) to finally crack the Kv1.3 code.

Takeaway: The global Kv1.3 landscape, though emergent, is rich with diverse players and strategies. This means potential partners abound – but choosing wisely requires understanding not just who is in the game, but what each player brings. With that landscape in mind, let's turn to the demand side of the equation: what are different markets looking for in a deal, and where might your asset fit best?

Deal Wind Vanes: Decoding Regional Licensing Preferences (Market Preferences)

Licensing is not a one-size-fits-all endeavor – different markets often have distinct "tastes" and norms when it comes to biopharma partnerships. Crafting a successful license-out strategy for your Kv1.3 program means appreciating these regional nuances. Here, we break down the key tendencies in three major arenas: North America, Europe, and Asia-Pacific.

North America – Innovation-Hungry, Willing to Bet Early

The US (and Canada) remain the world's biggest pharma market and the most aggressive deal-makers. Big Pharma in North America is constantly on the hunt for innovative therapies to replenish pipelines, especially as patent cliffs loom. In fact, biopharma companies increased their licensing investments by ~33% in 2024 vs 2023, indicating a renewed appetite for deals. What are they looking for? In a word, innovation – first-in-class mechanisms, novel biology, and sizable unmet needs. U.S. firms are often willing to bet on earlier-stage projects if the science is compelling and IP strong. For example, it's not uncommon to see preclinical or Phase 1 assets licensed for hefty sums when backed by breakthrough data. The Eli Lilly–D.E. Shaw Kv1.3 deal is a case in point: Lilly paid $60 million upfront for a lead-stage Kv1.3 inhibitor (far before Phase 2), essentially paying for the promise of an innovative mechanism.

That said, North American partners will subject your asset to rigorous due diligence. They expect a robust data package – compelling in vivo efficacy, clear MOA, strong patent protection, a manufacturability plan, etc. The bar is high, but so are the rewards: deal sizes in the US tend to be the largest, often structured with hefty upfronts, milestone payments that can total in the hundreds of millions, and tiered royalties. Deals can also be complex (options, co-development rights, etc.) as partners aim to balance risk. Speed is another hallmark – U.S. biotechs and pharmas move fast. If an asset is hot, you may find yourself in a whirlwind of back-to-back partnering meetings, term sheets flying within weeks. Being prepared to tell a sharp story and respond quickly to information requests is crucial to catch the window of opportunity.

Tip: For North America, highlight the uniqueness of your Kv1.3 program (what makes it first-/best-in-class) and have your science tight. Leverage any early human data or strong translational models – anything that de-risks the leap of faith. Also, be ready for a sophisticated negotiation; engage experienced deal advisors to navigate term complexities so you maximize value without missteps.

Europe – Proof-Oriented and Diligence-Driven

Europe's pharma giants (Roche, Novartis, Sanofi, GSK, etc.) are equally attuned to innovation but often lean toward assets with some clinical validation. European business development teams tend to be a bit more risk-averse on early-stage deals – they love cutting-edge science, but typically want to see at least proof-of-concept data in patients or a very clear line of sight to it. A completely novel Kv1.3 mechanism might intrigue them, but you may get more traction if you have Phase 1b/2a results showing, for example, psoriasis patients improved on your drug. The upside is that Europe hosts many large pharmaceutical companies with deep therapeutic area expertise (including in immunology) and established licensing infrastructures. They are constantly scanning for the right additions to their pipeline and have dedicated teams to facilitate partnerships across the continent's biotech hotspots.

European deals often have a reputation for being thorough and methodical. Expect a longer courtship and negotiation cycle compared to the U.S. It's not unusual for a licensing deal with a European big pharma to take 6–12+ months from initial contact to signing. Part of this is internal process: extensive due diligence is a given, involving not just scientific reviews but also detailed market analyses, pricing/reimbursement evaluations, and multi-level decision committees. (When HQ is in one country and R&D in another, alignments take time.) The other factor is that many European pharmas still prefer to see more mature data, which by nature takes time to generate or analyze.

In terms of deal structure, European partners can be just as generous as U.S. ones (global rights deals from European pharmas have reached blockbuster size). However, you might find lower upfronts but potentially higher downstream milestones in some cases, reflecting risk-sharing until POC is confirmed. Rest assured, if your asset truly meets a strategic need, European companies will compete vigorously – they have shown boldness in deals when the fit is right (witness Sanofi's multi-billion acquisitions or Novartis's aggressive in-licensing moves). Just be prepared to dot every "i" and cross every "t" – negotiations will delve deeply into IP, contingent scenarios, detailed development plans, etc. Clear communication and patience are key to not be overwhelmed by the thoroughness.

Tip: For Europe, emphasize your clinical evidence and real-world relevance. If you have any European KOL endorsements or regional trial data, leverage that to build confidence. Understand the target partner's portfolio gaps: does your Kv1.3 asset complement their immunology pipeline or offer something competitors don't? Articulating the strategic fit (not just the science) can accelerate buy-in. And don't be frustrated by a slower pace – use the time to build relationships within the organization; having an internal champion who truly understands your asset will pay off when their committees debate the deal.

Asia-Pacific (Japan & Beyond) – Late-Stage Appeal and Regional Focus

The Asia-Pacific region, especially Japan, has its own partnering dynamics. Japan's pharma companies (Takeda, Astellas, Daiichi Sankyo, etc.) have become more global in ambition – some now acquire assets outright globally – but regional licensing is still a major strategy. Japanese firms often prefer assets that have at least some clinical validation elsewhere. The ideal scenario: a drug that has shown efficacy in U.S./EU trials and can be licensed for development and commercialization in Japan/Asia. They value proven safety and efficacy because the Japanese market (and regulators) reward innovation that's demonstrated. For instance, Mitsubishi Tanabe licensed the Japan/Asia rights to a novel antibody (Regeneron's fasinumab) for ~$55 million upfront once it had solid Phase 2 data – a classic example of Japan's willingness to pay for a de-risked late-stage opportunity. Likewise, many Japanese deals are for Phase 2 or Phase 3 assets that a Western company doesn't plan to commercialize in Asia on its own.

Another feature in Asia, particularly Japan and South Korea, is interest in regional exclusivity. A Japanese pharma might not insist on global rights (unlike a US company); they're happy to secure Japan (or Pan-Asia) rights to a promising drug. This can be a win-win if your strategy is to license out in certain regions while keeping others. Japanese and Korean partners also bring strong local expertise – they can navigate local trials, regulatory approval, and have established sales networks in their markets. For a Kv1.3 drug, a partner like this could rapidly move it through Japanese Phase 1 bridging studies, etc., while you or another partner handle Western development.

However, it's important to note that deals in Japan can take time and meticulous effort. The process is famously detail-oriented. Japanese companies conduct very exhaustive due diligence (expect countless document requests and Q&As), and decisions often require consensus up multiple management layers. It's a bit of a slow courtship: patience, respect for process, and cultural sensitivity are paramount. The negotiation style may be less confrontational – don't mistake polite, lengthy discussions for lack of interest. Rather, they are ensuring every aspect is considered. One upside of this thoroughness is once a deal is signed, Japanese partners are typically very committed and principled collaborators.

Elsewhere in Asia, China's big pharmas and biotechs are increasingly doing global deals (sometimes out-licensing from China to West, but also in-licensing Western assets for China). They may show interest in a Kv1.3 asset if it aligns with disease prevalence and fits their portfolio. For example, a Chinese company might seek China rights to a global Kv1.3 drug for lupus or rheumatoid arthritis if they see domestic demand. Korea's companies (like Samsung Bioepis, LG Chem, etc.) also scout innovative assets, though often later-stage and for regional rights. The common thread in Asia is that clinical proof and a clear value proposition are crucial – you must convince partners how your drug will succeed in their market (e.g. is the disease common there? does it fit their strategic focus?).

Tip: When approaching Asia-Pacific partners, do your homework on the local market needs and regulatory pathways. For Japan, it can be highly effective to prepare a Japan-specific briefing: e.g. how atopic dermatitis or IBD impacts Japanese patients and how your drug could address a gap, backed by data. Showing you've thought about their perspective builds confidence. It's also wise to engage advisers or team members with regional experience – a bilingual liaison or a partner like Unibest (with a network in Asia) can help bridge cultural and communication gaps. Finally, be ready to negotiate regional deal structures (e.g. territory-specific milestones, rights reversion clauses if they don't get approval in X years, etc.). These details matter in making a deal workable for both sides.

Defining Your "Ideal Partner" and Kickstarting Negotiations (The How-To)

By now, we've mapped what you have (a coveted Kv1.3 asset) and who might want it across the globe. The next step is bridging the two: finding the ideal partner for your program and engaging them in a successful negotiation. This section provides a practical guide – a checklist for the partner of your dreams, and strategies to approach the negotiating table fully armed.

Sketching the Ideal Partner Profile

In any licensing-out effort, one should start with a clear picture of what a good partner looks like. Here are key criteria to consider when evaluating potential companies to court (and indeed, when triaging inbound interest):

Strategic Fit: The partner's pipeline and therapeutic focus should complement your asset, not compete with it. Ideal partners are those actively investing in your disease area or modality. For example, a pharma with a strong immunology franchise (but no Kv1.3 mechanism) might prize your drug as a pipeline extender. Conversely, if a company has a very similar in-house program, your asset might end up orphaned. Look for alignment in vision – you want a partner who will champion your Kv1.3 therapy as a strategic priority, not a side experiment.

Development & Regulatory Capabilities: Assess the partner's R&D muscle. Do they have a track record of successfully developing drugs in the relevant clinical area? For instance, if your Kv1.3 drug is for dermatology, a partner with dermatology trial experience and relationships with dermatology KOLs will add huge value. Check their ability to run efficient trials, navigate regulatory hurdles (e.g. fast-track approvals if applicable), and solve CMC/scale-up challenges. An ideal partner brings expertise that augments your own, ensuring the product will reach approval and patients.

Commercial Strength: Even the best drug can flop without good commercialization. An ideal partner has marketing and sales prowess in the target markets for your therapy. This includes understanding of pricing and reimbursement (especially crucial for autoimmune biologics or novel mechanisms), and established access to hospitals, clinics, or whatever channels matter for your indication. If, say, Japan is a key market, a partner with a large Japanese sales force is gold. Think about where your drug will be sold and find a partner who shines there.

Cultural and Partnership Fit: Often overlooked, culture can make or break collaborations. Is the company known to be a good collaborator? Have they successfully licensed-in products from biotechs before – and how did those partnerships fare? Some companies take a very hands-on, integrative approach; others leave partners more autonomy. Reflect on what you need. If you value scientific collaboration, a partner with a reputation for openness and technical exchange is ideal. Also consider size: a giant pharma can offer resources but might give a smaller asset less attention, whereas a mid-size specialty pharma might make your product its crown jewel. Alignment in working style and expectations (governance, decision-making, communication) is critical. The best partner is one where both sides feel like it's a win-win and are committed to mutual success, not just a transaction.

Financial and Deal History: Lastly, examine the partner's financial health and deal track record. Can they afford the deal structure you envision (upfront, milestones, etc.)? A cash-strapped partner could stall development if funding dries up. Also, have they honored past partnerships? Frequent litigation or terminated deals are red flags. Ideally, you want a partner experienced in licensing (so the process is smoother) with a positive reputation for how they treat collaborators. Look for any public info on past licensing deals – did they meet milestones, continue development, etc. Companies that have successfully licensed-in and launched products before are typically safe hands for your asset. As industry experts note, the most successful out-licensing deals happen when the asset perfectly aligns with the licensee's strategy and capabilities – that's the bullseye to aim for.

(Pro tip: Creating a scorecard for potential partners on the above factors can be very useful. It brings objectivity to what can otherwise become a "gut feeling" choice.)

The Pre-Negotiation Intelligence War

Finding a promising partner is only half the battle; next you must court and negotiate effectively. As any seasoned dealmaker will attest, information is power in negotiations. Before you even engage with a potential partner (or as early as possible), do your homework – essentially, run a "due diligence on your partner" just as they will on you. Here's how:

Leverage Public Sources: Comb through the company's annual reports, investor presentations, press releases, and recent earnings call transcripts. These often contain clues about their priorities ("Therapeutic Area X is a key focus for growth…"), gaps ("We are looking to bolster our pipeline in immunology…"), and even specific mention of business development aims. For example, if a pharma's CEO has publicly stated they intend to in-license a Phase 2 immunology asset this year, and you happen to have one, that's a green light. Also search clinical trial registries and scientific conference abstracts – is the company already involved in similar research? All this helps you tailor your pitch to their needs.

Understand Their Pain Points: Try to identify what problem your drug can solve for the partner. Are their key patents expiring (so they need new blood in pipeline)? Did their rival launch a new therapy (so they're playing catch-up)? Did a recent trial failure leave a hole in their portfolio? If you can frame your Kv1.3 asset as the answer to a partner's prayers, you shift the dynamic from selling to collaborating. For instance, if Company Y lacks a strong dermatology franchise and has been trying to enter that market, your psoriasis-targeted Kv1.3 drug could be their entry ticket – emphasize that.

Prepare a Killer Data Package: It should go without saying, but enter discussions armed with a high-quality, concise data package on your asset. This typically includes a non-confidential deck for initial talks (covering mechanism, preclinical/clinical data, differentiation, IP status, development plan) and a more detailed confidential dossier for due diligence (protocols, full datasets, CMC info, etc.). Know your data inside out. Anticipate the tough questions (safety margins? competitor analysis? biomarker plan?) and be ready with answers. A common mistake is under-preparing and then fumbling when a partner's scientists start probing – which can undermine confidence. Show that your team is world-class and has left no stone unturned. This not only increases your asset's appeal but also speeds up the process; well-organized data can shave weeks off Q&A cycles.

Intelligence on Negotiation Style: If possible, gather intel on how the target company negotiates. Do they have a "standard template" they push for deals? Are they flexible on deal terms or notoriously tough on certain clauses (e.g. rights of first refusal, commercialization commitments)? Information from industry peers, or even observing their past deal announcements, can help set expectations. For instance, some big pharmas always insist on worldwide rights, some are fine with regional carve-outs; some offer big biobucks but low upfront, others vice versa. Knowing this in advance helps you plan your own red lines and wish list for the deal.

At this juncture, many biotech executives realize that executing this "intel war" requires significant effort – and that's where partnering with an experienced advisor can pay dividends. External consultants (like Unibest) with a global network and specialized databases can dramatically boost the efficiency and depth of your research. They can quickly paint a 360° profile of potential partners, often catching strategic signals that might be missed by a small internal team. Moreover, advisors who have sat through multiple deal negotiations know the unspoken preferences and common pitfalls of various companies, which can be invaluable insight as you formulate your approach. In short, arming yourself with data and insight is the best preparation for a successful negotiation – and you don't have to do it alone if the task is overwhelming. Unibest's team, for example, has helped clients gather crucial intel on partners' pipelines, decision-makers, and negotiation styles, effectively giving you a "map" of the other side's likely moves before the game even begins.

From First Hello to Final Handshake: Negotiation Tactics

When it comes time to engage with a potential partner, keep these negotiation principles in mind:

Lead with Value, Not Price: In initial discussions, focus on the value and potential of your Kv1.3 asset, not the price tag. Establish a shared excitement about what the drug could achieve (for patients and for the partner's business). If you've done the steps above, you can articulate how your asset fits the partner's strategy – make them feel like this is their idea, the missing puzzle piece they've been seeking. Once they're intellectually and emotionally sold, the monetary negotiation will be on firmer ground. Prematurely haggling can sour the mood; instead, create a vision of a mutually beneficial outcome (the win-win).

Know Your Worth (and Limits): Determine your minimum acceptable deal before you negotiate. What upfront and total deal size would you deem fair given benchmarks? What non-financial terms (e.g. retaining certain rights, co-development options, etc.) are must-haves or deal-breakers? Also, decide in advance how far you're willing to go on exclusivity during negotiations – many big companies will ask for a period where you can't talk to others. You might grant it if they're far ahead, but ensure it's time-limited. By knowing your walk-away points, you'll negotiate with confidence and avoid being caught off-guard. Be mindful of the latest market comps: if similar assets got $100M upfront recently, and a partner offers you $10M, you'll have data to justify a counter. (At the same time, consider the whole package – a high royalty might compensate for a lower upfront, etc.)

Structure for Success: Licensing deals come with a slew of possible structures – milestones for development, regulatory, sales; royalties; options; profit-shares; territorial splits; you name it. Be creative and flexible. Maybe your partner balks at a big upfront – could you settle for a smaller upfront but earlier milestone payments? Perhaps you believe strongly in the drug's long-term sales – push for higher royalties instead of a one-time fee. If a partner only wants rights in certain countries, think if that can work for you (sometimes splitting regions yields multiple deals that sum bigger than a single global deal). A well-structured deal aligns incentives: both parties should feel they win if the drug succeeds. Spend time on scenario planning – if the first Phase 2 fails but a second indication works, how are milestones handled? If sales explode beyond projections, are royalties capped or not? Clarify these while everyone's friendly. It prevents disputes down the road.

Due Diligence is Two-Way: Remember, while the partner diligences you, you should diligence them too (harking back to the ideal partner profile). During discussions, ask questions about their development plan, their resource commitments, how many projects the team handles (will yours be priority or one of dozens?). Gauge their enthusiasm – are the senior execs involved or only junior scouts? A genuinely interested partner will be happy to discuss their vision for your program. If something feels off (e.g. they're evasive about committing resources), take note. It's better to identify a misalignment before signing than to end up with a lackluster partnership. In successful deals, both sides are fully bought in and trust each other's capabilities.

Maintain Optionality (until it's time to commit): As the saying goes, "Don't put all your eggs in one basket." Unless you've granted exclusivity, it's wise to keep talking to multiple potential partners in parallel. This competitive tension often strengthens your position and ensures you have a Plan B if one deal falls through. Of course, be professional – you shouldn't mislead anyone about where they stand, but it's fair to say there is other interest. If you do give a partner an exclusive negotiating window, be sure it's for a short, defined period and that they are truly serious (perhaps tie it to a milestone, like they present a draft term sheet within 4 weeks, etc.). Time is precious for a biotech; you don't want to be strung along. An ideal outcome is receiving multiple term sheets and then leveraging them to get the best overall terms.

Finally, mind the relationship. Negotiation isn't just about dollars – it's the start of a long-term relationship. Be firm on key points, but also fair and respectful. A confrontational, win-at-all-costs approach can poison the well before the partnership even begins. Licensors and licensees often continue working together for years (even decades); the tone you set now will echo later. Aim for a deal where both parties feel respected and excited to collaborate. That lays the groundwork for the real victory: successfully co-developing and commercializing a therapy that improves patients' lives.

From Map to Route: How Unibest Helps You Fast-Track Global Partnerships (The Solution)

By now, it's clear that navigating the global license-out journey for a drug – especially an innovative one like a Kv1.3 asset – is complex. It's akin to having a map full of valuable information (global pipeline data, market intel, partner profiles) and needing to chart an actual route to your destination (a successful deal and development partnership). This is where Unibest comes in as a seasoned guide, turning the map into a planned route and then helping you travel it.

Data to Insight – A Dynamic Navigator: Unibest's strength lies in transforming raw data into actionable insights. We maintain an extensive, continually updated internal database of global drug development and deal activity – far beyond what publicly available sources offer. In the Kv1.3 arena, for example, our Data Intelligence Platform not only tracks the projects listed in this article, but also keeps tabs on behind-the-scenes movements: new patent filings, unpublished preclinical results, shifts in company pipelines, and even whispers in the BD community of who might be shopping for what. This dynamic intelligence means that when you partner with Unibest, you get real-time navigation. If a major pharma suddenly expresses interest in ion channel immunomodulators, you'll know. If a competitor's Kv1.3 program quietly stalls, that's intel we leverage to position your asset as the leading program. In short, we ensure you're always a step ahead of the trend, not reacting after the fact. It's like having a GPS that not only knows the roads, but the traffic and weather conditions too – so we can reroute you proactively for the smoothest journey.

Precision Matching – More Than a Broker: A common misconception is that advisors simply introduce Company A to Company B and take a back seat. Unibest's philosophy is "precision matching" – we delve deep into understanding both our client's asset and the potential partners' true needs, and then facilitate a match where the interest is naturally mutual. It's not about blasting a teaser to a hundred companies; it's about finding that handful of truly ideal partners (the "sweet spot" profiles we discussed earlier) and then using our network and credibility to get those partners to the table in a meaningful way. Our team members are stationed across major markets (North America, EU, Asia) and come from industry backgrounds, so we speak the local languages – literally and figuratively. We know how a U.S. biotech CEO thinks versus what a Japanese pharma BD head needs to hear. This cultural fluency bridges gaps that often hinder international deals. In practice, when you engage Unibest, we work with you to craft a compelling narrative for each target region, leveraging our insider knowledge. For a Kv1.3 client, we might highlight the asset's T-cell targeting to an immunology-focused company in Boston, while emphasizing its first-in-class status for atopic dermatitis to a dermatology leader in Europe, and focusing on its clinical proof and Japan relevance to a Tokyo pharma. Each angle is tailored, yet the core message is consistent: your asset is a treasure and we guide partners to see that value.

End-to-End Support – From First Data Package to Final Deal Structure: Unibest's role doesn't stop at making introductions. We effectively become an extension of your team throughout the deal process, ensuring no step falls through the cracks. Remember the "intelligence war" and "data package prep" we discussed? We roll up our sleeves alongside you for those. Our experts help assemble and polish your data room, ensuring your preclinical and clinical data are presented in the best light and anticipating partner questions (often we'll do a mock diligence Q&A to stress-test everything). We conduct valuation analyses and compile comparable deal benchmarks so you enter negotiations armed with evidence of your asset's worth. When term sheets come in, our dealmakers help design creative deal structures that maximize value and minimize risk for you – whether it's negotiating a co-development option so you can retain certain rights, or structuring milestones to secure more upfront economics. We also keep an eye on the long game: the operational clauses that will govern how you and your partner work together post-deal. It's easy to focus on headline price and forget things like governance, dispute resolution, commercialization obligations – but we don't. Unibest's experience in closing numerous cross-border deals means we know where pitfalls commonly arise, and we strive to address them in the contract so you are protected and empowered. Our goal is to leave you not only with a signed contract, but with a partnership that is set up for success in practice.

Real-World Success (Case Study): To illustrate, a mid-sized Asian biotech developing an autoimmune therapy recently sought Unibest's help to license it to a Western partner. Within 6 months, we leveraged our network to secure multiple interested parties, guided the biotech in selecting the best-fit partner (a European pharma looking to expand in immunology), and facilitated a deal that included a healthy upfront payment, milestones exceeding what the biotech had initially expected, and importantly, a commitment by the pharma to conduct certain Asia-specific trials at their cost (a term we negotiated given the biotech's interest in its home market). This deal closed faster and on better terms than the client imagined – a testament to how the right guidance converts a hopeful opportunity into a tangible outcome.

In summary, Unibest acts as your co-pilot on the journey: providing the data compass, charting the course, and even helping steer and adjust as conditions change. We are passionate about helping innovative therapies like Kv1.3 blockers find the partnerships they need to reach patients worldwide. Our international reach and hands-on approach mean that whether you need that first opening introduction or final fine-tuning of a complex agreement, we have you covered every step of the way. In the vast sea of global pharma deals, let Unibest be the experienced navigator that guides you to safe harbor and prosperous trade.

(Interested in how Unibest can specifically help your project? Check out our NewCo/License-Out services or reach out for a one-on-one consultation.)

Conclusion & Call to Action

Kv1.3 may be a relatively new star on the drug discovery horizon, but as we've seen, it's powering a wave of opportunities in the autoimmune arena. The global pipeline is already bustling with activity – from scrappy startups to pharma heavyweights – and the coming 1–2 years will likely see pivotal data readouts, deals, and maybe even the first Kv1.3 therapy reaching the market. For biotech companies holding a promising Kv1.3 asset, the time to act is now. The window of opportunity to position yourself as a front-runner is wide open, but success will require savvy navigation: understanding where your asset fits in the global puzzle, choosing the right partners, and executing deals that unlock the asset's full value.

The key takeaway is that "successfully going global" is not just about the science – it's about strategy. Even a potentially game-changing drug can falter if it doesn't find the right champion to propel it through costly late-stage trials and into clinics worldwide. Conversely, a well-executed partnership can accelerate development, amplify the drug's reach, and generate far greater returns (for both you and your partner) than going it alone. It all boils down to one critical decision: choosing the right partner. As we discussed, that decision should be guided by alignment in goals, complementary strengths, and a shared vision for the product. Pick the right ally, and your Kv1.3 program could ride a rocket from bench to global market; pick poorly, and even good science could languish.

At Unibest, we deeply understand what's at stake. We're here to ensure that your "hidden gem" doesn't stay hidden, and that you secure the partnership that will transform it into a worldwide success. Is your Kv1.3 project ready to take on the global stage? If the answer is yes – or if you're unsure and want expert guidance – now is the time to act. We invite you to reach out to our team for a personalized consultation. Let's chart a tailored roadmap for your asset, connect you with the best-matched partners from our global network, and ultimately, get your innovation the spotlight it deserves.

Contact Unibest today to explore how we can support your journey – from data to deal to success. Together, let's turn your Kv1.3 opportunity into a global triumph.

Sources of Key Data and Insights:

Synapse by PatSnap – Insight on Kv1.3's role in inflammation and market scope. Notably reported the correlation of Kv1.3 upregulation with ulcerative colitis T-cell activity, the global IBD patient count (~8 million) and forecast of the autoimmune therapeutics market reaching $140B by 2028. Also highlighted Eli Lilly's $60M upfront licensing deal for D.E. Shaw's Kv1.3 program (DES-7114).

BioSpace (Feb 2025) – Licensing deal trends in 2024. Reported that biopharma companies spent on average 33% more on licensing deals in 2024 vs 2023, and that upfront payments for Phase II-stage assets jumped ~460% compared to 2022, underscoring the high value of mid-stage proof-of-concept in dealmaking.

Locust Walk Insights – Regional dealmaking in Japan/Asia. Provided an example of a Japanese pharma (Mitsubishi Tanabe) paying $55M upfront for regional rights to a Western biologic, illustrating Asia's preference for in-licensing later-stage innovative assets. Also noted the thorough, detail-oriented nature of Japanese partnership processes.

Unibest Data Intelligence Platform – Internal data source. Aggregated global Kv1.3 pipeline information (active programs, stages, indications, companies) used in this article's analysis and figures. This proprietary platform compiles public and private data to give an up-to-date landscape of drug R&D and deal activity (as referenced in Figures 1–3 and related text).

Laboratorios Rubio – Licensing Trends 2025 – Emphasized the importance of aligning out-licensing deals with partners' capabilities and strategic needs. Advised developing comprehensive partner profiles (financial strength, development expertise, commercial infrastructure, cultural fit) for successful licensing-out, reinforcing the partner selection criteria discussed.