The GLP‑1 Era’s Triumphs and Limitations

GLP-1 analog injections like semaglutide (Wegovy/Ozempic) have revolutionized obesity and diabetes care, delivering unprecedented weight loss but not without side effects.

Over the past few years, GLP‑1 receptor agonists (GLP-1 RAs) such as semaglutide (branded as Wegovy for obesity and Ozempic for diabetes) and tirzepatide (dual GIP/GLP-1 agonist, branded as Mounjaro for diabetes; expected as “Zepbound” for obesity) have achieved remarkable success in treating type 2 diabetes and obesity. These drugs have shown unprecedented efficacy in weight reduction – clinical trials report average body weight losses on the order of 15–21% or more for high-dose regimens. For instance, a recent study presented at ADA 2025 found that a higher-dose semaglutide (7.2 mg weekly) produced a 21% mean weight loss over 72 weeks, with one-third of patients losing at least 25% of their body weight. Such outcomes were once thought achievable only with bariatric surgery. The commercial impact has been equally impressive – surging demand for GLP-1 drugs has led analysts to forecast the global market for obesity treatments to reach $150 billion by 2035, up from ~$15 billion in 2024. GLP-1 RAs have truly ushered in a “once-in-a-generation” breakthrough in metabolic medicine.

Despite this glory era for GLP‑1 therapies, there are notable limitations and concerns. Tolerability is a major issue – up to 50–70% of patients on GLP-1 drugs experience gastrointestinal side effects like nausea, vomiting or diarrhea. In trials, about 40% of Wegovy users and 30% of tirzepatide (Zepbound) users reported nausea, and real-world experience shows many discontinue treatment within a year due to these side effects. Long-term safety and adherence remain under observation, especially as these agents are used chronically by a broad population. Additionally, with the first wave of GLP-1 drugs (e.g. liraglutide) now past or nearing patent expiry, and even semaglutide and tirzepatide facing a patent cliff in the 2030s, the field is anticipating a post-GLP-1 landscape. There will be a huge market opportunity (or gap) for new therapies to fill the void or complement GLP-1s once generics and competitors arrive. In short, GLP-1 RAs have set a high bar but also exposed unmet needs – namely improved tolerability, sustained efficacy, and alternative mechanisms to continue advancing metabolic treatment. This backdrop raises the key question: what comes after GLP‑1? One promising answer may lie in an often-overlooked hormone co-secreted with insulin – amylin.

What Is Amylin? Mechanism and Therapeutic Potential

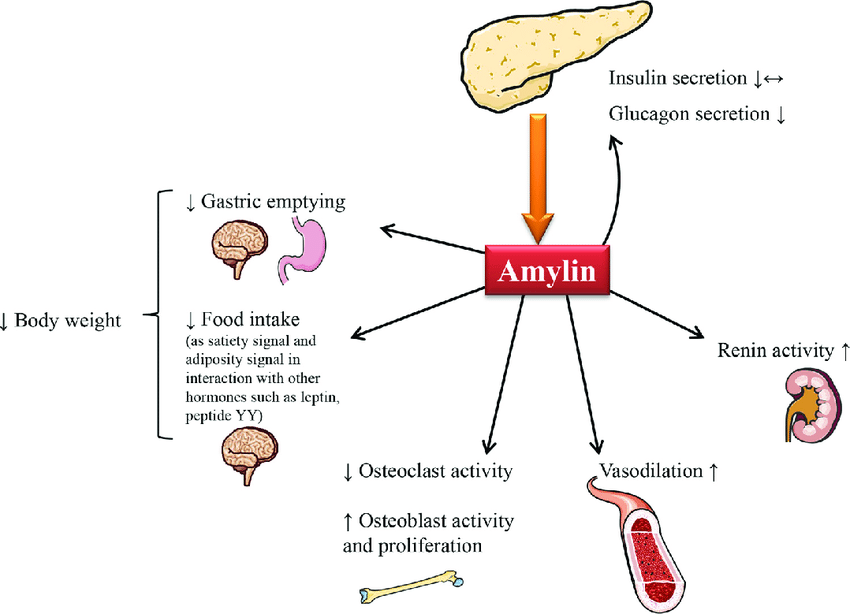

Schematic of amylin’s multifaceted actions—slowing gastric emptying, suppressing food intake, modulating glucagon, and affecting vasodilation—underscoring why it’s now viewed as a promising metabolic target

Amylin, also known as islet amyloid polypeptide (IAPP), is a 37–amino-acid peptide hormone that is co-secreted with insulin by pancreatic β-cells in approximately a 100:1 ratio (insulin:amylin). While insulin primarily works to lower blood glucose by promoting uptake and storage, amylin plays a complementary role in post-prandial glucose regulation. Amylin’s physiological actions include slowing gastric emptying, suppressing inappropriate glucagon secretion, and promoting satiety, thereby preventing sharp post-meal spikes in blood sugar. In essence, when you eat, amylin is released alongside insulin to “put the brakes” on digestion and appetite, modulating the rate at which glucose enters the bloodstream and making you feel full sooner. This coordinated mechanism helps smooth out post-meal glycemic excursions.

It’s important to contrast amylin vs GLP‑1: both are peptide hormones that reduce blood glucose, but they act on different receptors and pathways. GLP-1 (an incretin from the gut) stimulates insulin release and also delays gastric emptying somewhat, whereas amylin works via distinct amylin receptors in the brain (area postrema) to strongly slow gastric emptying, curb glucagon, and signal satiety. GLP-1 agonists primarily enhance insulin and satiety through the GLP-1 receptor; amylin analogs act independently, so combining the two can have additive effects. Notably, individuals with diabetes (especially type 1 diabetes) have an absolute or relative amylin deficiency – since pancreatic β-cells are destroyed or dysfunctional, they secrete little to no amylin along with the lack of insulin. This deficiency is believed to contribute to unstable post-meal glucose levels and reduced satiety in diabetics. In fact, amylin is so crucial yet deficient in diabetes that it inspired the development of amylin analog drugs to replace its function.

The therapeutic allure of amylin lies in its unique mechanism and potential to address needs unmet by GLP-1 alone. By leveraging amylin’s effects, one could achieve better post-prandial glucose control and appetite suppression via a complementary pathway. Additionally, amylin action may preferentially affect weight loss quality – emerging evidence suggests amylin agonism can lead to greater loss of fat mass while preserving lean muscle compared to GLP-1 agonism. This makes physiological sense: amylin’s satiety and gastric slowing might help reduce caloric intake in a way that spares muscle protein catabolism, an important consideration for obesity treatments. Overall, amylin analogues hold significant therapeutic potential in diabetes and obesity management, either as adjuncts to insulin/GLP-1 therapy or as standalone agents. The next sections will explore how this potential is being realized in clinical development and whether “Amylin is the new GLP-1” in the making.

Clinical Progress: Amylin Analogs in Solo and Combo Therapies

In the wake of GLP-1’s success, researchers and pharma companies have turned their attention to amylin-based therapies. Both amylin analog monotherapies and GLP-1/amylin combination regimens are advancing in clinical trials, aiming to replicate or exceed GLP-1’s efficacy with improved tolerability.

Below we review the major developments:

Pramlintide (Symlin) – This was the first amylin analog to reach the market. Pramlintide is a synthetic analog of amylin with three proline substitutions (to reduce amyloid aggregation) and was approved in 2005 as an adjunct to insulin for type 1 and insulin-treated type 2 diabetes. It showed modest improvements in HbA1c and weight. However, pramlintide’s use has been limited by its inconvenient dosing (it’s a short-acting injectable that must be taken before each meal, separate from insulin injections). While pramlintide confirmed the concept that replacing amylin can improve postprandial control (without causing hypoglycemia or weight gain), its real-world impact was minor. The focus has since shifted to long-acting amylin analogs that could be dosed weekly and to combining amylin with GLP-1 agonists for synergistic effect.

Cagrilintide (AM833) – Developed by Novo Nordisk, cagrilintide is a long-acting amylin analogue optimized for once-weekly injection. In mid-stage trials for obesity, cagrilintide monotherapy demonstrated meaningful weight loss. For example, a Phase 2 trial in people with type 2 diabetes showed cagrilintide (2.4 mg weekly) achieved ~8% body weight reduction in 32 weeks, outperforming semaglutide 2.4 mg (~5% loss). More impressively, when cagrilintide was combined with semaglutide – the combo termed CagriSema – the Phase 2 results showed 15.6% weight reduction at 32 weeks, versus 5.1% with semaglutide alone. This confirmed a powerful additive effect when GLP-1 and amylin agonists are used together. Cagrilintide itself is now in Phase 3 as part of the CagriSema combination. In fact, just this year the pivotal Phase 3 trials (REDEFINE program) reported groundbreaking results: in adults without diabetes, CagriSema (semaglutide + cagrilintide) cut body weight by 20.4% after 68 weeks compared to 3.0% with placebo. Even in people with type 2 diabetes, CagriSema led to ~13.7% weight loss vs 3.4% with placebo over 68 weeks, while also dramatically improving glycemic control (74% of patients on CagriSema achieved HbA1c ≤6.5% vs 16% on placebo). These outcomes rival the best seen with any single-agent therapy and underscore the potential of GLP-1 + amylin co-therapy. Novo Nordisk is expected to file for regulatory approval of CagriSema in the near future, positioning it as a next-generation treatment following Wegovy. (For companies interested in similar combination pipeline opportunities, Unibest’s licensing team can help identify and connect with such late-stage projects – e.g. facilitating a license-in deal to bring a CagriSema-like candidate to new markets. Our NewCo Licensing Pipeline list showcases many phase II/III metabolic candidates available for partnerships – see the Unibest pipeline catalog for current opportunities.)

Petrelintide (ZP8396) – Petrelintide is an up-and-coming amylin analog from Zealand Pharma (recently partnered with Roche). It is engineered for once-weekly dosing and has shown strong early results. In a Phase 1b trial, petrelintide achieved an 8.6% average body weight loss in just 16 weeks, compared to 1.7% for placebo. This ~7% placebo-adjusted drop in 4 months is very encouraging and actually appears more potent than cagrilintide’s results over similar time frames. Notably, petrelintide also had a good tolerability profile, with about one-third of patients reporting mild nausea (one discontinuation), which was lower than the nausea rates seen historically with GLP-1 drugs (e.g. ~40% with semaglutide in trials). This suggests a potential tolerability advantage for amylin analogs. Roche was impressed enough to strike a $5.3 billion collaboration deal with Zealand in 2025 to co-develop petrelintide – including use as a monotherapy and in combo with Roche’s GLP-1/GIP dual agonist (acquired from Carmot). The goal is to harness petrelintide as a foundational obesity therapy, potentially launching around 2030 if Phase 3 trials succeed. This big pharma interest validates amylin’s promise as “the next big thing.” (Unibest played a role in facilitating some of the initial contact between Zealand and Roche through our network – a testament to our license-in/out consulting services. We can similarly assist other pharma companies in identifying promising amylin analog programs and negotiating co-development or licensing deals, leveraging our 20+ years experience in global partnership facilitation – see Unibest’s NewCo/License-Out services for how we support such collaborations.)

CagriSema and Next-Gen Combos – As mentioned, Novo Nordisk’s CagriSema (semaglutide + cagrilintide) is leading the pack in late-stage combo development. Despite extremely positive Phase 3 results, it’s worth noting Novo’s expectations were sky-high and the initial data, while stellar (20% weight loss), came in slightly below some lofty projections, causing a brief market overreaction. Nonetheless, CagriSema is poised to become the first dual GLP-1/amylin therapy on the market. Eli Lilly is not far behind – they have an internal long-acting amylin analog (coded LLY- or nicknamed “eloralintide”) in Phase 2. Lilly is testing eloralintide in combination with tirzepatide (their GLP-1/GIP agent) in obesity, with data expected in 2025. This could potentially become another powerful combo (“amylin + incretin + GIP”). Other companies are exploring triple agonist approaches (though not all involve amylin – some are GLP-1/GIP/glucagon triples like Lilly’s retatrutide, which showed up to 24% weight loss in 36 weeks in Phase 2). Interestingly, Novo Nordisk has hinted at an “Amycretin” strategy – essentially designing single molecules or co-formulations that target amylin + incretin receptors together. One such obesity candidate, referred to as “Amycretin” in investor news, yielded an impressive 24% weight reduction at high dose (20 mg) in a recent trial. While details are sparse, this underscores how the future of metabolic therapy may belong to multi-target approaches, with amylin analogs playing a central role. Early-stage programs from other players (AstraZeneca, AbbVie with their acquired Gubra analog, smaller biotechs, etc.) are rapidly emerging, making the amylin space a hotbed of innovation.

Overall, the clinical pipeline indicates amylin-based therapies are coming of age. Both standalone amylin analogs (like petrelintide, Gubra’s compound) and GLP-1/amylin combos (CagriSema, Lilly’s dual) are progressing toward market. They aim to achieve equal or greater weight loss than today’s GLP-1s, with fewer side effects and potentially added benefits. In the next section, we delve into how these amylin approaches stack up in terms of efficacy, safety, and unique advantages.

Comparing Efficacy and Potential Advantages

A key question is whether amylin analogs (alone or in combos) truly offer advantages over the existing GLP-1 therapies. Let’s compare some clinical outcomes and other benefits:

Weight Loss Efficacy: In terms of raw efficacy, the best amylin-inclusive regimens are matching the “double-digit” weight loss benchmark set by GLP-1 drugs. CagriSema delivered ~20% mean weight loss in non-diabetic obesity at 68 weeks – on par with high-dose tirzepatide (~21% in SURMOUNT-1) and even exceeding what standard semaglutide 2.4 mg can do (~15%). As monotherapy, weekly amylin analogs might not quite reach those heights alone (e.g. 8–10% in Phase 2 trials), but when paired with GLP-1 they clearly have synergistic effects. Notably, weight loss from these agents tends to continue to improve over time (the curves have not plateaued by 16 or even 32 weeks, suggesting longer trials may show even greater losses). For instance, petrelintide’s 8.6% at 16 weeks likely would translate to much higher at 1 year. Thus, efficacy-wise, amylin analogs are proving they can “run with the pack” and even lead it when used in combos.

Glycemic Control: Amylin analogs can improve postprandial glucose by curbing glucagon and gastric emptying, complementing GLP-1’s insulinotropic effect. In CagriSema’s diabetes trial, patients achieved significantly better A1c reductions than GLP-1 alone, and nearly 75% hit normal HbA1c targets. Importantly, amylin analogs do not increase hypoglycemia risk on their own (since they don’t stimulate insulin directly). The glycemic benefits are especially relevant for type 1 diabetics, who lack amylin entirely – pramlintide showed adding amylin can smooth out mealtime glucose spikes for them. Future long-acting analogs could bring this benefit with less burden. In short, on top of weight loss, amylin-based treatments offer robust glucose-lowering support – a dual win for metabolic health.

Tolerability – GI Side Effects: A major potential advantage of amylin analogs is improved tolerability, particularly gastrointestinal (GI) side effects. GLP-1 RAs notoriously cause nausea/vomiting by acting on brainstem appetite centers. Amylin agonists also cause some nausea (the area postrema is a target), but emerging data suggests the incidence and severity might be lower. For example, petrelintide’s trial reported ~33% nausea incidence and only one dropout for GI issues, compared to ~44% nausea and higher dropout rates in semaglutide’s trials. Roche even stated petrelintide could be “best-in-class… with improved tolerability compared to current weight management treatments”. Additionally, amylin + GLP-1 combinations might allow lower dosing of each component, potentially reducing side effects while maintaining efficacy. In the Phase 2 CagriSema results, the combo was described as well-tolerated, with side effect profiles comparable to semaglutide alone. All of this points to amylin analog regimens possibly being easier on patients – meaning fewer who quit due to feeling sick. This is a crucial edge for long-term obesity therapy, where adherence is key.

“Quality” of Weight Loss (Body Composition): Intriguingly, amylin may confer a body composition benefit. Anecdotal reports from animal studies and expert analyses suggest weight loss via amylin agonism leads to proportionally greater fat mass loss and less lean muscle loss compared to GLP-1. A Leerink Partners analysis dubbed amylin the “hottest new mechanism” partly because it could improve the quality of weight loss – “greater reductions in fat instead of lean muscle”. In a head-to-head preclinical study, petrelintide preserved lean mass in obese rodents significantly better than liraglutide did. Clinically, this could mean patients on an amylin analog might lose more inches off the waist while retaining more muscle strength. Preserving muscle is important for metabolic health and physical function as one loses weight. It’s too early for definitive human data on this, but if confirmed, it gives amylin therapies a distinct advantage over GLP-1-only approaches.

Cardiovascular and Other Benefits: GLP-1s have shown cardiovascular outcome benefits (e.g. Wegovy reducing major CV events by 20%). It remains to be seen if amylin analogs share or enhance these benefits. Since they promote weight loss and possibly improve lipid profiles (via reduced food intake and weight), it’s likely they will have positive impacts on blood pressure, fatty liver, etc. Upcoming long-term studies (like Lilly’s SURPASS-CVOT for tirzepatide and presumably similar for CagriSema) will shed light on heart and renal outcomes. Some hypothesize that the multi-hormonal approach (amylin+incretin) could further reduce risks of conditions like NAFLD or sleep apnea beyond what GLP-1 alone does, due to more weight loss and different receptor effects – but this awaits clinical validation.

In summary, amylin-based treatments appear to offer comparable or superior efficacy with potential improvements in tolerability and body composition. They may allow patients to lose weight more comfortably and healthily – shedding fat while keeping muscle. Of course, these advantages must be confirmed in large trials, but the signs are promising. For patients who cannot tolerate GLP-1 side effects or those who plateau on GLP-1 therapy, an amylin analog (or combo) could be a game-changer. It’s this profile that has so many experts excited for an “Amylin era” in metabolic therapy.

Challenges and Risk Factors

While the amylin class is full of potential, developers face several challenges and risks in bringing these therapies to market. It’s important to acknowledge and plan for these factors:

Complex Receptor Biology: Amylin’s mechanism is not as straightforward as GLP-1’s. Amylin exerts its effects via the calcitonin receptor complex (AMY1/2/3 receptors formed by calcitonin receptors with RAMP co-receptors). This is a more complex receptor system to target pharmacologically. Designing an analog that reliably engages the right receptor subset without off-target effects is tricky. The pharmacodynamics can be hard to optimize – too much activation can cause nausea, too little gives no efficacy. The recent review in Diabetes Therapy noted that translating amylin to the clinic has been hampered by “complex receptor biology” and suboptimal animal models. Companies have overcome some of this with engineered analogs (like pramlintide’s modifications and new stabilized analogs), but it remains a scientific challenge to fully exploit amylin’s action in humans.

Formulation and Pharmacokinetics: Native amylin is amyloidogenic (it tends to form insoluble fibrils) and has a very short half-life. Pramlintide solved the aggregation issue with mutations, but it still clears quickly, hence the thrice-daily dosing. The next-gen analogs use various tricks (fatty acid derivatization, etc.) to extend half-life to weekly. Even so, ensuring consistent absorption and action over a week or more is a formulation challenge. Some analogs might require high doses or novel delivery systems. There’s also the possibility of immunogenicity – as analog peptides, repeated injections could trigger anti-drug antibodies in some patients (though so far this doesn’t seem prominent in trials). These PK/PD complexities mean R&D teams must do extensive optimization. Any hint of formulation instability or unexpected kinetics can delay development.

Amyloid and Safety Concerns: The word “amylin” itself hints at one risk – its propensity to form amyloid deposits. In type 2 diabetes, amylin aggregates in pancreatic islets and may contribute to β-cell destruction. While therapeutic analogs are modified to avoid this, regulators will watch closely for any signs of tissue deposition or amyloid-related toxicity, especially for chronic use. Another safety area is cardiovascular risk – ironically, while weight loss helps the heart, high doses of any vasoreactive peptide might have unforeseen effects (like tachycardia or blood pressure changes). Long-term cardiovascular outcome trials (CVOTs) will likely be required for any obesity indication (similar to GLP-1 drugs) to ensure there are no increases in MACE (major adverse cardiac events). Likewise, thyroid C-cell changes (seen with high GLP-1 levels in rodents) might need monitoring with amylin analogs, as the calcitonin receptor is in the same family.

Regulatory and Clinical Trial Hurdles: Developing an obesity or diabetes medication has inherent challenges: trials must be large and long to demonstrate not just weight loss but also safety on clinical endpoints. For combination products (like GLP-1 + amylin), regulatory pathways can be complex – agencies may require demonstrating the contribution of each component, as well as combination safety (for instance, proving that co-administration doesn’t cause unmanageable side effects or rare events). Designing trials that satisfy these requirements (e.g. factorial designs or large Phase 3 programs) is costly and time-consuming. Additionally, for type 1 diabetes, demonstrating outcomes with an amylin analog (as adjunct to insulin) requires very careful titration and might face skepticism after pramlintide’s modest uptake. Companies will need clear data on A1c improvement or time-in-range metrics to justify its use in T1D.

Patient Acceptance and Adherence: On the commercial side, even if a drug works well, patients must accept it. Injectable therapy is one barrier – though weekly shots are easier than daily, many obese or diabetic patients prefer oral pills. GLP-1 pills (oral semaglutide, etc.) are emerging; if amylin treatments remain injectables, they might be seen as less convenient. There’s also the question of combination therapy complexity: Will patients need to inject two drugs (GLP-1 and amylin) separately? Novo is likely working on a co-formulation (CagriSema in one pen), but not all combos may have that. Cost is another factor – these will be advanced biologic drugs, presumably expensive. Payers may push back unless outcomes are clearly superior to cheaper options. As we’ve seen with GLP-1s, insurance coverage can lag, affecting who can access them. Lastly, as more players enter (including generics down the line), the competitive landscape will tighten, possibly driving prices down or favoring those with best marketing.

Manufacturing and Supply Chain: Amylin analogs are peptides, some quite large or complex (cagrilintide is 8 amino acids linked to a fatty acid, etc.). Manufacturing such peptides at scale with high purity is non-trivial. The global supply chain already struggled with surging demand for GLP-1 drugs; adding multi-peptide combos could strain it further. Companies must invest in peptide synthesis capacity or innovative expression systems. From a quality control perspective, ensuring batch consistency for these analogs is vital – any variability can affect efficacy or safety. (Unibest’s expertise in pharmaceutical supply chain and quality control becomes very relevant here. With two decades of on-the-ground experience in China’s pharma manufacturing, we help partners identify reliable API sources and implement rigorous QC protocols – see our Quality Control and Cost Control services. For example, we can assist a client in sourcing cagrilintide peptide intermediates or petrelintide API from qualified producers, ensuring both quality and cost-effectiveness are optimized.)

In summary, while the science and market opportunity for amylin analogs are compelling, execution will be key. Companies must navigate the scientific hurdles of a complex hormone, de-risk the safety profile, satisfy regulators with robust trials, and convince payers and patients to embrace these therapies. The good news is that the path has been partially paved by GLP-1 drugs – many stakeholders now understand the value of metabolic therapies for obesity, and there’s huge enthusiasm. By learning from past lessons (e.g. pramlintide’s pitfalls, GLP-1 rollout issues), the amylin class can overcome these challenges. The next section examines the broader market outlook and how competition is shaping up in this space.

Market Outlook and Competitive Landscape

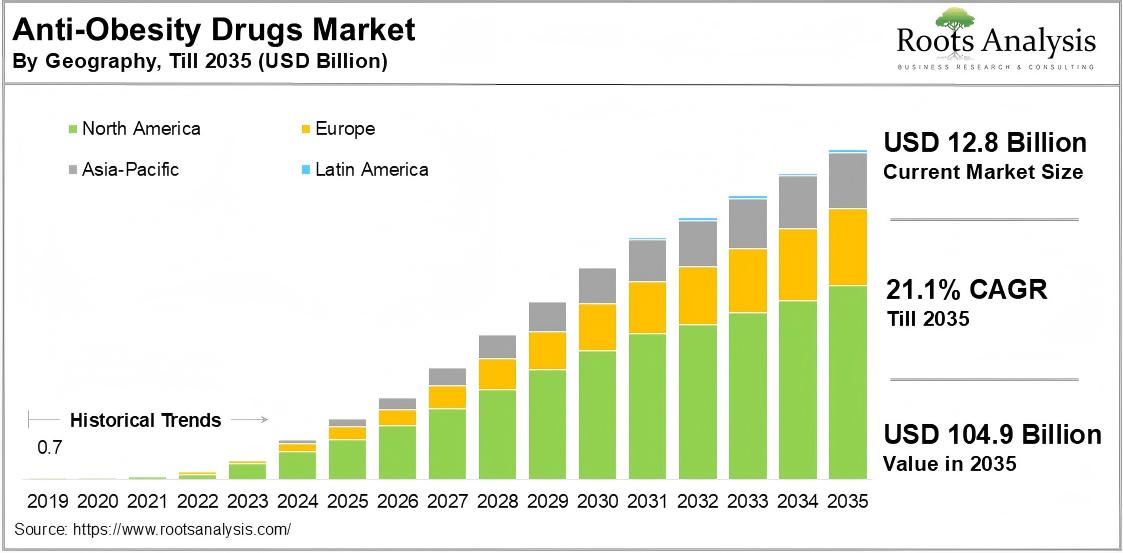

Forecasted growth of the global obesity drug market through 2035, illustrating the $150 billion opportunity ahead—even beyond GLP‑1

The metabolic disease market is vast and rapidly expanding, and the rise of amylin analogs is occurring against this backdrop. Some key points on the market landscape:

Massive Market Potential: With obesity and type 2 diabetes rates climbing worldwide, the demand for effective treatments is enormous. By one estimate, over 1.3 billion people globally could medically benefit from obesity pharmacotherapy. Morgan Stanley projects the global obesity drug market to reach $150 billion by 2035, which would make it one of the largest pharmaceutical segments ever. GLP-1-based drugs are expected to dominate a large share of this, but there is plenty of room (and need) for additional mechanisms. Amylin analogs are poised to capture a significant slice of this pie, especially if they differentiate on safety or can be combined with GLP-1 for superior outcomes. Analysts have noted that current GLP-1 leaders (Novo Nordisk, Eli Lilly) can’t meet all the global demand alone – and indeed, supply shortages have been an issue. This opens the door for new entrants and combination regimens to fill unmet needs and geographic gaps.

Intense Pharma Interest and Investment: Sensing the opportunity, many pharmaceutical companies have jumped into the fray. Big Pharma deals are a clear indicator. In 2023–2025 we’ve seen multi-billion dollar partnerships centered on amylin assets: Roche’s $5.3B alliance with Zealand Pharma for petrelintide, AbbVie’s $2.2B licensing deal with Gubra for a phase-1 amylin analog, and others. AbbVie, a bit late to the obesity race, explicitly sought an amylin candidate to catch up with Novo and Lilly. AstraZeneca has also reportedly been exploring amylin agonists (having missed out on GLP-1 after acquiring Bristol’s diabetes unit). Smaller biotech players (e.g. Amylin Pharmaceuticals’ spiritual successors) are advancing candidates too, often quickly snapped up by larger firms. The trend is clear: amylin is seen as the next strategic pillar for anyone wanting to compete in obesity/diabetes. It’s reminiscent of the scramble a few years ago around GLP-1, but now the playing field might be more level since everyone recognizes the stakes early. For companies that don’t have an in-house program, the route is via licensing or partnerships – which is exactly where Unibest can assist by leveraging our network to broker connections between innovators and commercial partners. (Our global licensing service has helped firms secure rights to promising metabolic drug candidates to enter new markets quickly.)

Competitive Differentiation – What Will Win? In a crowded field, future market winners will be those who differentiate on efficacy, safety, or convenience. GLP-1s set a high efficacy bar; amylin combos might push it higher (as we’ve seen with >20% weight loss). But efficacy alone might not guarantee dominance – tolerability (GI side effects) could become a key differentiator. If one amylin analog causes significantly less nausea or better long-term adherence, it could gain favor. Route of administration is another front: most current candidates are injections, but there is interest in oral formulations or less frequent dosing (monthly injections, etc.). An oral amylin mimetic would be a game-changer (though delivering a peptide orally is very challenging – some companies are trying oral GLP-1, which might pave the way technologically). Combination vs monotherapy is another strategic choice – Novo’s bet is that combos (CagriSema) will be superior, whereas a company like Zealand initially pursued petrelintide as a monotherapy and a combo add-on. It could be that many patients start on a GLP-1, then an amylin analog is added later if needed (similar to how multiple diabetes drugs are layered). In any case, those with broad portfolios (GLP-1, amylin, maybe triple agonists) can offer payers a package or patients a sequence of therapies, potentially securing market share. Pricing and access will also shape competition – if companies can manage to supply at scale and reduce costs (especially important as more countries and health systems adopt obesity drugs), they will capture more volume. As a result, having a strong supply chain and cost advantage (for example, through partnerships in lower-cost manufacturing regions) could be an edge for some players.

Long-Term Strategies: Looking further out, one can envision multi-modal obesity treatment plans. Amylin analogs might be used in combination with GLP-1, or even as part of triple therapy (for instance, GLP-1 + GIP + amylin). There are also other pathways being targeted (like GLP-1 + glucagon co-agonists, GIP agonists, etc.). The ultimate treatment might be an injection that covers three or four hormones at once for maximal metabolic reset – a concept already being tested (e.g. the triple agonist retatrutide). In that scenario, amylin is likely one of the components because of its unique satiety and gastric effects that you can’t get from incretins alone. Companies are thus hedging by developing multiple candidates: for example, Lilly has retatrutide (triple) and an amylin dual in parallel; Novo has CagriSema (dual) and is exploring a triple (some rumors of adding a glucagon agonist as well). Gene therapy or microbiome approaches are dark-horse competitors in the long run, but those are far earlier. For the next decade, the battle will be between hormonal therapies – and amylin analogs have secured their position in that fight.

From a Chinese market perspective (since Unibest is China-based): obesity and diabetes are massive public health issues in China. Yet, access to the latest drugs (like Wegovy) has been limited or lagging. There is a tremendous opportunity for bringing in novel therapies to China through licensing or co-development. Chinese pharma companies are actively looking to license-in advanced metabolic drug candidates from Western biotechs, while Western firms eye China as a huge market for obesity treatments. Unibest, with our China presence, is uniquely positioned to facilitate these cross-border collaborations. For instance, we can help a client license an overseas amylin analog into China and handle everything from tech transfer to CFDA regulatory filing. Conversely, we can assist innovative Chinese biotechs in out-licensing globally by identifying the right partners. (Our Drug Substance/Product registration service and local market know-how ensure that such partnerships navigate regulatory hurdles smoothly.) The competitive landscape in China will likely include domestic players developing “me-too” or biosimilar GLP-1 and amylin drugs, so speed is of the essence for any company aiming to establish a foothold.

Bottom line: The market for diabetes and obesity therapeutics is on the cusp of a new wave. GLP-1s have opened the floodgates, and amylin analogs are riding the momentum. Those pharma companies that effectively incorporate amylin into their portfolio – whether through internal R&D or strategic deals – stand to ride the obesity drug boom and capture substantial value. In the next section, we discuss how Unibest can support companies in this endeavor, leveraging our strengths in supply chain, partnerships, and end-to-end project execution.

Unibest: Accelerating Your Amylin Strategy

In this fast-evolving landscape, Unibest offers a unique value proposition to pharmaceutical companies looking to capitalize on the “amylin wave.” We are a seasoned pharma solutions provider with two decades of experience, particularly in bridging Chinese and global markets. Here’s how Unibest can empower your amylin analog initiatives:

Global Licensing & Partnership Facilitation: Identifying the right partner or asset is often the first hurdle. Unibest’s business development team can leverage our extensive network to scout innovative amylin analog programs (or complementary GLP-1 assets) and connect you with their owners. Whether you’re seeking to license-in a late-stage candidate (like a CagriSema or petrelintide) or license-out your proprietary molecule to international collaborators, we can manage the process end-to-end. Our NewCo Licensing Pipeline is a curated list of high-potential new drug projects (including metabolic disease) available for partnership – a resource we continuously update. We have successfully brokered deals similar to the Roche–Zealand and AbbVie–Gubra agreements by assisting in due diligence, valuation, and negotiations. With Unibest’s support, you can strike partnerships faster and more smoothly, ensuring you don’t miss out on the amylin opportunity due to network gaps or delays.

China Market Entry & Supply Chain Advantage: Unibest’s home base in China offers a strategic edge. China is not only a huge potential market for obesity/diabetes therapies, but also a premier location for cost-efficient, high-quality pharmaceutical manufacturing. We help clients leverage China’s strengths in two ways: First, if you have a novel amylin or peptide drug, we can guide you through clinical development and registration in China (covering IND/NDA filings, local trials, and regulatory compliance via our DS/DP registration service). Second, we can tap into our vast network of GMP-certified manufacturers for active pharmaceutical ingredients (APIs) and intermediates. For example, we have relationships with peptide synthesis specialists who can produce analogs like cagrilintide or peptide building blocks at scale. Our API product catalog and pharma intermediates catalog showcase some of the materials we handle. By utilizing China’s supply chain (while maintaining top-notch quality control), we help clients achieve significant cost savings in production, which can be crucial for competitive pricing and large-scale supply. We also handle export logistics to ensure your product reaches global markets efficiently.

One-Stop Project Support – from Lab to Launch: Unibest prides itself on being a comprehensive solutions partner. When you embark on developing or launching an amylin analog, numerous pieces need to come together: market analysis, technical due diligence, CMC development, quality control, regulatory strategy, clinical trial management, and eventually commercialization. Rather than juggling multiple vendors, you can rely on Unibest as a single point of contact. For instance, after helping you in-license a promising amylin candidate, we can assist in Tech Transfer to a manufacturing site, oversee method validation, set up a stringent QC framework (Quality Control is one of our core competencies), and prepare the regulatory dossiers for different regions. Our team has experience with peptide drugs, injection formulations, and the specific analytical challenges they pose. We can also advise on trial design for obesity indications and coordinate with CROs. When it comes time to launch, our commercial experts can craft market entry strategies, distribution plans, and even help with tendering in hospital systems. In short, Unibest can drive your project from concept to market in a timely and compliant manner.

Customized Solutions for Client Needs: We understand that each client (and each project) is unique. Maybe a biotech needs a turn-key solution to out-license their amylin analog while ensuring the partner will maintain quality – we can set up a “quality gatekeeper” system on their behalf. Perhaps a pharma company wants to quickly add an amylin analog API to their portfolio – we can source a reliable supplier or set up a contract manufacturing deal, handling audits and IP protection. If a partner is concerned about TPP (Target Product Profile) alignment or tech integration, our scientific team steps in to align the developmental or manufacturing plan with those goals. Unibest’s flexibility and client-centric approach mean we will custom-fit our services to solve your pain points. Our track record includes facilitating tech transfers for complex injectables, implementing cost-control measures that saved clients millions, and ensuring quality standards that passed both FDA and EMA inspections for products manufactured in China. These are the same capabilities we bring to any client aiming to ride the amylin wave.

In essence, Unibest acts as your ally and enabler in the amylin therapeutics arena. By partnering with us, companies large or small can move faster, operate leaner, and execute with confidence in this competitive space. We merge Western pharma standards with Eastern efficiency and cost advantage – a combination that can accelerate your journey to market leadership in the post-GLP-1 era.

Action Plan: Riding the Amylin Wave

For pharmaceutical companies looking to seize the opportunities in amylin analogs and related metabolic therapies, here are some strategic action steps to consider:

Prioritize Pipeline Opportunities: Conduct a pipeline audit or scouting exercise for amylin-related candidates. Identify biotech firms or research institutes with Phase II/III-ready amylin analogs or combo therapies. Prioritize those with compelling data (e.g. ≥10% weight loss in mid-stage trials, good tolerability) for potential licensing or acquisition. If you lack internal bandwidth, engage a partner like Unibest to source and vet these opportunities on your behalf. Speed is crucial – the best assets are being snapped up quickly.

Initiate Licensing/Collaboration Discussions: Once targets are identified, open lines of communication for license deals or co-development. Craft a win-win pitch – for example, offer to co-fund Phase III or expand the candidate into new markets (like China, where you have strength). Structure agreements wisely: consider options like regional licensing (e.g. rights in Asia) or joint ventures for commercialization. Also explore partnering with companies owning complementary pieces (if you have GLP-1 and they have amylin, a combo co-development could be ideal). Unibest can facilitate introductions and support due diligence and deal negotiations to expedite this process.

Invest in Manufacturing & Supply Chain Early: Secure your manufacturing strategy for the amylin analog as early as possible. If it’s a peptide, evaluate contract manufacturers with peptide synthesis capabilities or plan to scale up in-house facilities. Lock in supply of raw materials/intermediates (which could involve specialized amino acids or coupling reagents) – shortages can occur once multiple programs advance in parallel. Begin developing a robust CMC plan (formulation, device for injection, stability studies). It’s wise to engage suppliers in China or other cost-competitive regions to keep COGS down – but ensure they meet global quality standards. Unibest can connect you to qualified API and intermediate producers and implement quality oversight, as well as help with tech transfer to manufacturing sites.

Plan Differentiated Clinical Development: Design your clinical program to highlight differentiators of your amylin therapy. For example, include body composition DXA scans to prove lean mass preservation benefit, or patient-reported outcome measures on satiety and quality of life. Plan for the needed outcome trials (cardiovascular safety, etc.) and engage regulators early (seek FDA breakthrough designation if criteria are met, to speed things up). If developing a combo (e.g. with GLP-1), strategize on trial designs to show additive benefit. Consider special populations too – e.g. an amylin analog could be tested in type 1 diabetes or in patients who failed GLP-1 therapy, to carve out niche indications initially. An efficient, differentiation-focused clinical plan will position your product strongly against competitors.

Develop a Market Access and Commercialization Strategy: Even during R&D, keep the endgame in mind. Market access will be key for obesity drugs – start dialogues with payers about what data they need to reimburse (for instance, demonstration of sustained weight loss or improvement in comorbidities). Build health-economic models showing the value of your therapy (e.g. reduction in diabetes cases, improved quality-adjusted life years). On the commercial side, if you’re aiming for markets like the US, EU, and China, decide where to launch first and whether to partner or go solo in each. Educate healthcare providers early – many physicians are not yet familiar with amylin analogs, so medical affairs can prime the field via scientific publications and conference presentations. Also, consider patient preference studies (would a weekly dual-agonist injection be preferred over two separate injections, etc.). In short, map out how you will position, price, and promote your amylin product in the context of GLP-1 incumbents. Unibest’s market analytics team can assist with market research and tailored go-to-market plans, especially in Asian markets.

Mitigate Risks with Backup Plans: Given the challenges discussed, have a risk mitigation plan. For scientific risks, perhaps maintain a backup candidate (or formulation) in case the lead has issues – e.g. a second-gen analog with an alternate sequence. For regulatory risk, engage in continuous dialogue with authorities and adapt quickly to any safety signals or requirements (if a surprise issue like antibody development arises, be ready with data to address it). For supply risk, diversify suppliers and secure long-term agreements for critical materials. Also, monitor competitor movements – if a rival is far ahead, strategize whether to differentiate or perhaps focus on a different population. Flexibility and proactive risk management will ensure you can navigate obstacles without derailing the overall mission.

By following these steps, companies can position themselves to ride the amylin analog wave rather than be swamped by it. The key is early action and strategic investment – much like the early movers with GLP-1 reaped outsized rewards, those who move now on amylin could become the next market leaders in metabolic disease.

Conclusion: Seizing the Amylin Opportunity with Unibest’s Support

In conclusion, the rise of amylin analog drugs represents a promising “next chapter” in diabetes and obesity treatment. GLP-1–based therapies have achieved unprecedented success, but their limitations and the sheer scale of metabolic diseases mean new approaches are urgently needed. Amylin agonists have now emerged from the shadows, demonstrating the potential to match or even exceed GLP-1 results, while possibly offering better tolerability and improved quality of weight loss. We are witnessing what could be a changing of the guard – or at least the addition of a powerful new member – in the arsenal against diabetes and obesity. Amylin analogs (alone and in combination with incretins) may well become the heirs to GLP-1, sustaining and advancing the progress in metabolic health over the coming decade.

For pharmaceutical innovators and investors, the message is clear: the time to act is now. The amylin field is heating up rapidly – major players are striking deals and moving candidates into Phase 3. Those who hesitate risk getting left behind in a market that could be worth hundreds of billions and transform standard of care for hundreds of millions of patients. By proactively engaging with this field – whether through R&D, partnerships, or strategic acquisitions – companies can ride the wave and secure a foothold in the next big obesity/diabetes franchise.

Unibest is here to be your dedicated partner in this journey. Our unique blend of global vision and local expertise can remove obstacles and accelerate your success. From pinpointing the right drug candidates and partners, to ensuring a reliable cost-effective supply chain, to navigating regulatory pathways and maintaining top-tier quality standards, Unibest provides the support system you need to capitalize on the amylin opportunity. We have the experience, connections, and technical know-how to turn your ambition into reality – so that your organization can help build that “new high ground” in diabetes treatment and benefit immensely in the process.

The coming years could herald an “Amylin era” that complements and eventually succeeds the GLP-1 era. By joining forces with Unibest and executing a smart strategy now, you can ensure that your company is at the forefront of this exciting frontier. Contact Unibest today to explore how we can empower your amylin analog or metabolic disease projects – together, let’s seize this moment and deliver the next generation of life-changing therapies to patients worldwide.

Sources:

Morgan Stanley Research – Obesity drugs market forecast

MarketWatch via Quartz – GLP-1 drugs’ uptake and side effect profile

Novo Nordisk STEP UP trial (ADA 2025) – High-dose semaglutide 7.2 mg results

BioPharma Dive – Petrelintide Phase 1b weight loss data and tolerability

BioSpace – Roche & Zealand deal for petrelintide; Phase 1b data (8.6% weight loss)

Novo Nordisk press release (2022) – Phase 2 CagriSema vs semaglutide vs cagrilintide results

American College of Cardiology (ADA 2025 coverage) – REDEFINE 1 trial (CagriSema 20.4% weight loss)

PubMed (Volčanšek et al., 2025) – Amylin in diabetes: mechanism, challenges (abstract)

BioSpace – AbbVie & Gubra deal; Leerink quote on amylin benefits (fat vs lean, tolerability)

Investing.com – Novo’s “amycretin” trial result (24% weight loss at 36 weeks)